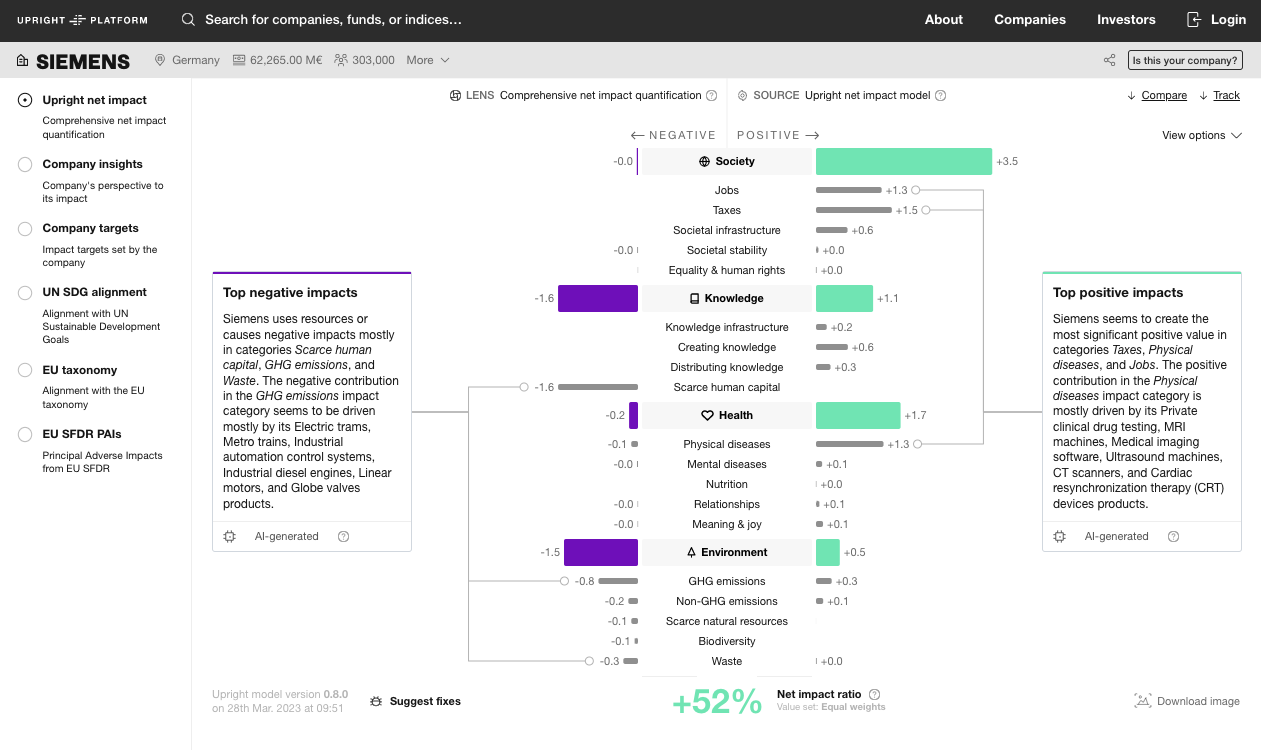

MEASURE YOUR NET IMPACT

Upright’s comprehensive and science-backed platform, trusted by 200+ leading investors and companies, enables you to measure the actual impact of companies' products and services – beyond mere compliance.

4 REASONS WHY THE OLD WAY ISN'T WORKING

- Companies are stuck on looking at how to minimize resource use, and don't fully comprehend the positive outcomes they create.

- We tend to discuss significant negative business impacts alongside smaller improvements, like office paper recycling.

- Companies often concentrate solely on measuring internal impacts, neglecting up- / downstream effects.

- Companies tend to confuse compliance practices with impact. For instance, being signatories of the UN Global Compact does not make the net impact of tobacco companies positive.

HOW WE'VE DESIGNED THE UPRIGHT NET IMPACT MODEL

Upright's net impact model, based on the analysis of 200+ million scientific articles, is designed to satisfy the following needs:

MEASURE NET

The Upright model considers both costs and gains, and provides their net sum. The result is a company's net impact – the measure of net value creation of a company as a whole.

COMPREHENSIVENESS

The Upright model considers all types of costs and gains, instead of only focusing on environmental costs, financial gains, or another single metric. This informs decision-making on resource allocation.

WHOLE VALUE CHAIN

The Upright model measures the costs and benefits created throughout the whole value chain of a company, not just what happens inside the company or how it affects its immediate stakeholders.

COMPARABILITY

All estimated costs and benefits produced by the Upright impact model are comparable with each other. You can compare results within industries, across industries, and across different types of costs and benefits.

SCALABILITY

With Upright's AI-enabled model, estimating a company's impact doesn't require any manual work. This has enabled the model's large-scale adoption. With 24,000+ companies already on the platform, you can trust the data's significance.

ADAPTABLE VALUES

The Upright model doesn't assume universal values. Instead, the model accomodates to individual decision-makers' views of value and different optimization criteria when making decisions in different roles.

TRUSTED BY 200+ LEADING INVESTORS AND COMPANIES

"AC Ventures was drawn to Upright's reputation as the most authoritative and transparent mechanism for building a more sustainable and equitable future. There is no ESG platform as elegant as Upright’s, and we are thrilled with the clear results it delivered for us."

Lauren Blasco

Head of ESG at AC Ventures

.png)

"Securitas is very happy to have been working with Upright already since 2020. [T]he net impact profile highlights our holistic impact and helps us look at impact as an opportunity rather than risk management. We use -- net impact in our annual report to explain the value of our business."

Cecilia Alenius

Group Sustainability Officer, Securitas

.png)

"We have been using Upright since 2019 and it has become a crucial part of our sustainable investment process. We use Upright net impact data in our portfolio management, reporting and in meeting EU regulatory requirements. In addition, we recently launched our first sustainable bond SFDR Article 9 fund with the help of Upright."

Markus Lindqvist

Director, Sustainability at Aktia

WANT TO LOOK UNDER THE HOOD?

HAVE A LOOK AT OUR WHITEPAPER

Upright's core business is our Net Impact model that measures and summarizes both positive and negative impacts of a given company, while also allowing for comparability between companies and across types of impact.

Dive into the workings of our model by

downloading our whitepaper.